Why Is My Account Negative After I Deposited a Check?

Have you ever found yourself in a situation where you deposited a check into your bank account only to discover later that your account balance had gone negative? It can be an unsettling experience, and you’re likely wondering what happened and how to fix it. In this article, we will explore the reasons why your account may have gone negative after depositing a check and provide you with guidance on what steps to take.

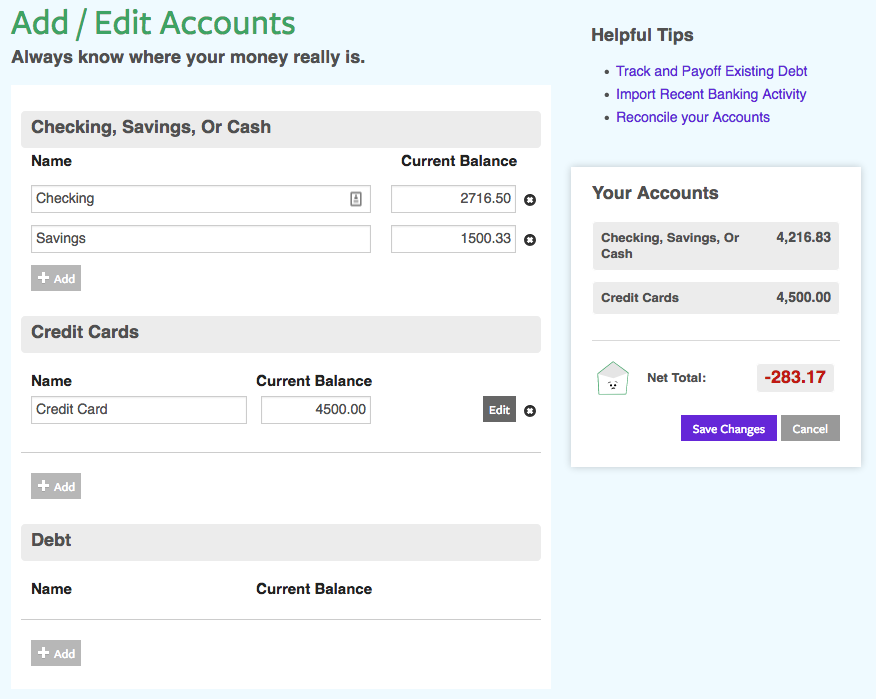

Before we delve into the potential causes, it’s essential to understand that bank deposits do not result in instant access to the funds. There is typically a hold period, which can vary depending on the bank and the type of check deposited. During this hold period, the deposited funds are not available for immediate withdrawal or use.

Causes of a Negative Account Balance After Check Deposit

Holds and Dishonored Checks

One of the most common reasons for a negative account balance after depositing a check is a hold placed on the funds by the bank. This is a security measure to reduce the risk of fraud or bounced checks. The bank may place a hold on the funds until they have verified the check’s validity, which can take a few days or even weeks.

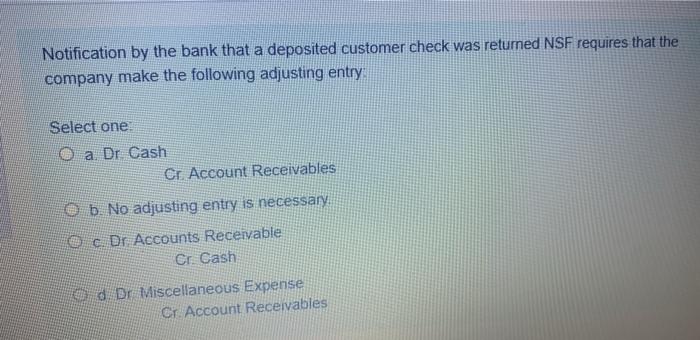

If the check is dishonored or returned due to insufficient funds or other reasons, the bank will reverse the deposit and deduct the amount from your account balance. This scenario can lead to an overdraft, resulting in additional fees and charges.

Bank Errors

While uncommon, bank errors can also contribute to a negative account balance after depositing a check. These can include incorrect handling of your deposit or processing errors that may result in the reversal of funds or the deduction of incorrect amounts from your account.

Unprocessed Checks

If you deposited a check in person or via an ATM, it may not have been processed immediately. There can be delays in clearing your check, especially if it was deposited on a non-business day or during peak banking hours. These delays can affect your available balance, and if uncleared checks exceed the amount deposited, it could lead to a negative account balance.

Other Factors

Apart from the primary causes, there are other factors that can contribute to a negative account balance after a check deposit:

- Outstanding Debits: Pending transactions, such as automatic bill payments, may be deducted from your account before the deposited funds become available, resulting in a negative balance.

- Overdraft Protection: If you have overdraft protection enabled, your bank may have temporarily covered the negative balance by transferring funds from another account or granting you a credit line. This may prevent overdraft fees but will still leave you with a negative balance that needs to be addressed.

Tips for Avoiding Negative Account Balances

To prevent finding yourself in a negative account balance situation after depositing a check, consider the following tips:

- Be Mindful of Hold Periods: Allow ample time for the check to clear before accessing the funds. Check with your bank for specific hold periods applicable to your deposits.

- Verify Check Validity: Before depositing a check, ensure it is from a valid source and has not been altered. If possible, call the issuer to confirm the check’s authenticity.

- Deposit Checks Promptly: Avoid waiting several days to deposit your check, as this can increase the chances of holds or delays in clearing.

- Keep a Record: Keep a record of your check deposits, including the amount, date, and check number. This documentation can be helpful if you need to dispute any errors or discrepancies.

Frequently Asked Questions

Q: Why didn’t my account balance increase immediately after depositing a check?

A: Banks typically place holds on deposited funds to verify the check’s validity and prevent fraud. This hold period may vary depending on the bank’s policies and the type of check deposited.

Q: What are some ways to reduce the risk of a negative account balance after depositing a check?

A: Be mindful of hold periods, verify the check’s authenticity, deposit checks promptly, and keep a record of your deposits. Additionally, consider using online banking or mobile banking apps to monitor your account balance regularly.

Q: What should I do if my account has gone negative after depositing a check?

A: Contact your bank immediately to inquire about the hold status of the check. If the hold is still in effect, you may need to wait for it to expire. However, if the check has been dishonored, you will need to make arrangements to cover the negative balance and resolve any outstanding issues with the issuer of the check.

Conclusion

Experiencing a negative account balance after depositing a check can be frustrating, but understanding the potential causes and taking preventive measures can help you avoid this situation. By knowing about bank holds, dishonored checks, bank errors, and other factors that may affect your account balance, you can make informed decisions and minimize the risk of overdrafts and additional fees. If you encounter any issues or have further questions, do not hesitate to contact your bank for assistance.

![Show a deposited check image on Chase.com [SOLVED] | J.D. Hodges](https://www.jdhodges.com/wp-content/uploads/2015/04/chase-check-image-show.png)

Image: www.jdhodges.com

Image: www.chegg.com

Irs Direct Deposit Number – TAX Longer delays may apply if you have overdrawn your account repeatedly in the previous 6 months. In this case, the first $100 will become available immediately; an additional $100 will be made available during nightly processing. The rest of the sum will be made available the second business day after the bank receives the deposit.